Perspectives: Mitigating Risks in a Fossil Fuel Free Portfolio

Over the past few years there have been a record number of studies analyzing the financial impacts of staying invested or avoiding fossil fuels — and the results demonstrate that investors can seek competitive returns while potentially experiencing advantages such as reducing their risk of holding potentially devalued assets. We also know that for a growing number of investors, fossil fuel companies pose distinctive risks that are not manageable to the extent required to make them attractive investments. It is no wonder that with the ethical, political and potential financial advantages, more people are looking for information on how to go fossil fuel free.

Investing in fossil fuel stocks carries inherent risk. Carbon-based energy companies’ economic models are being disrupted by increasing climate regulation, a clear trend of rising production costs without corresponding growth in reserves, and increasing competition from cleaner renewable energy technologies. As such, fossil fuel companies may be facing a prolonged decline. Furthermore, health, safety, and environmental hazards and geopolitical instability only amplify the risks of investing in fossil fuel companies.

Not investing in fossil fuel companies also involves risk, as the Energy sector comprises more than 6% of both the S&P 500 and MSCI ACWI Index. The biggest risk to fossil fuel free portfolios is the lack of exposure when energy stocks are outperforming the broader market and the diversification benefits realized with full sector representation. Investors can work to mitigate these risks at the portfolio level by substituting stocks that have a high correlation with the Energy sector, stocks with comparable characteristics to energy producers, and stocks of companies that supply energy via renewable means or provide products/services that reduce energy reliance. An investor can pursue one, two, or a combination of all three alternatives based on the current market environment in order to maintain a risk/return profile similar to, and arguably better than, a portfolio with direct fossil fuel exposure. A fossil fuel free investor would also avoid some of the volatility associated with oil supply/demand imbalances, much like the one we are witnessing today.

Not investing in fossil fuel companies also involves risk, as the Energy sector comprises more than 6% of both the S&P 500 and MSCI ACWI Index. The biggest risk to fossil fuel free portfolios is the lack of exposure when energy stocks are outperforming the broader market and the diversification benefits realized with full sector representation. Investors can work to mitigate these risks at the portfolio level by substituting stocks that have a high correlation with the Energy sector, stocks with comparable characteristics to energy producers, and stocks of companies that supply energy via renewable means or provide products/services that reduce energy reliance. An investor can pursue one, two, or a combination of all three alternatives based on the current market environment in order to maintain a risk/return profile similar to, and arguably better than, a portfolio with direct fossil fuel exposure. A fossil fuel free investor would also avoid some of the volatility associated with oil supply/demand imbalances, much like the one we are witnessing today.

As of year-end 2015, the Materials and Industrials sectors have exhibited the highest degree of correlation with the Energy sector over the past one, ten, and twenty year time periods. In addition, many companies within these sectors provide products/services to traditional energy companies, even helping to increase efficiencies and reduce environmental impacts for the Energy sector overall. As such, substituting appropriate Materials and Industrials sector stocks can help investors achieve Energy sector-like stock price exposure. For example, Swedish air compressor equipment manufacturer Atlas Copco, has a global service network and innovates for sustainable productivity in the oil and gas industry. The company’s energy efficient products are continuously developed and improved to reduce emissions and increase its customers’ competitiveness. Moreover, companies, such as Atlas Copco, are less likely to be negatively impacted should regulation dictate that much of the proven fossil fuel reserves remain in the ground, because their products/services are complimentary to other industries. Fossil fuel companies need to extract proven reserves in order to fund operating expenditures and service debt.

Large cap energy stocks generally trade at low relative price-to-earnings multiples and with above-average dividend yields under normal market conditions. These companies account for the majority of the major indices’ energy allocation. The weighted average market cap for the Energy sector within the MSCI ACWI Index was over $100 billion at the end of 2015, down from over $120 billion at the end of 2014, and down from around $140 billion at the end of 2013. The price-to-earnings ratio of the MSCI ACWI Energy sector at the end of 2015 rose to slightly above the overall index, but only because earnings declined significantly.

The energy sector generally trades at lower valuation multiples. The price-to-earnings ratio of the MSCI ACWI Energy sector at the end of 2014 was the lowest among the ten economic sectors and more than 20% below the index overall, which is consistent with historical valuation levels. The dividend yield of the MSCI ACWI Energy sector dwarfs the other ten economic sectors at around 4.5%. At the end of 2014, only the Telecommunication Services sector has a higher yield than the Energy sector. Stocks with these attributes can be found within all of the economic sectors, but are most prevalent in the Technology and Healthcare sectors today. Holding these types of companies which have positive correlation to the energy sector could further the objective of achieving correlation with the Energy sector.

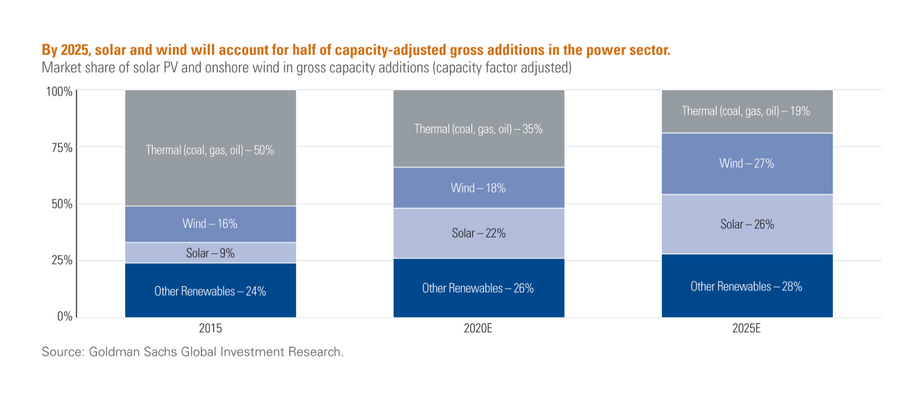

Substituting environmental technology stocks for fossil fuel stocks may also be a viable option given the more attractive growth prospects for clean energy solutions. Research has been published from major securities firms that takes a bearish perspective regarding fossil fuel sectors and bullish position with regard to renewable energy. For example, Goldman Sachs forecasts that the added capacity of renewable energy will surpass fossil fuel capacity additions significantly in coming years. Economic sector analysts at Trillium have long held this view.

There are numerous “alternative” investment opportunities that provide exposure to the world’s growing need for additional energy infrastructure. Wind, solar, hydroelectric, and waste-to-energy stocks are top of mind. Emerging renewable technologies, including fuel cell and tidal generated energy, may also become attractive substitutes at some point. Furthermore, many engineering and construction companies are leveraged to the space. Energy efficiency is another way to benefit from rising energy demand. Companies that have business models based around energy efficiency have a tendency to perform well when the economic cycle is in the expansion phase and fossil fuel costs are highest, i.e. when “traditional” energy stocks perform best.

In summary, it is possible to produce risk adjusted returns that are competitive with appropriate broad market benchmarks through a portfolio that does not invest in fossil fuel companies.

Increasingly, investors are choosing to eliminate all traditional energy from their portfolios, and have found that this approach has minimal negative impact on performance over the long-term. In fact, at Trillium, nearly half of our assets under management are managed in a fossil fuel free investment strategy.

Note: This article was written by Trillium Portfolio Manager Tony Tursich, CFA and appears in the Spring/Summer 2016 issue of Trillium’s newsletter, Investing for a Better World.®

Important Disclosure. The views expressed are those of the author and Trillium Asset Management, LLC as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast of future events or a guarantee of future results. These views may not be relied upon as investment advice. The information provided in this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. The securities mentioned were selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is for informational purposes and should not be construed as a research report.